Diving within the mysteries of forex analysis can seem intimidating for beginners. However, with a solid grasp and a systematic approach, you can master the knowledge behind successful forex trading. Start by familiarizing the essentials of forex exchange, including currency pairs, tools, and order types.

- Develop a consistent trading plan that outlines your objectives, risk management techniques, and entry/exit points.

- Explore various technical analysis indicators such as moving averages, RSI, and MACD to detect trends and potential trading setups.

- Remain informed about market events that can influence currency rates.

Implement your skills with a demo account before committing real capital. Remember, forex trading involves patience, discipline, and continuous education.

Unlocking Forex Success: Fundamental Analysis Strategies

Fundamental analysis forms a crucial role in forex trading success. It involves scrutinizing economic indicators, market trends, and geopolitical events to forecast currency valuations. By acquiring the underlying factors that drive currency values, traders can make strategic decisions about their trades.

A key aspect of fundamental analysis is monitoring major economic releases, such as inflation reports and employment figures. These indicators provide valuable insights into the strength of a country's economy and can significantly impact currency demand. Traders should also factor in geopolitical events, such as elections or trade agreements, which can create volatility in the forex market.

To improve the effectiveness of fundamental analysis, traders can utilize various tools and resources, such as economic calendars, news feeds, and analytical reports. By keeping up-to-date on these developments, traders can gain a competitive edge.

Unveiling Price Action: Technical Analysis for Forex Traders

Navigating the volatile realm of Forex trading requires a keen understanding of price action. Technical analysis, specifically focused on chart patterns and indicators, empowers traders to predict potential market movements. By analyzing historical price data, traders can discover trends, support and resistance levels, and candlestick formations that reveal future price direction. Mastering these techniques enables traders to make informed decisions and capitalize on market opportunities.

- Understanding the intricacies of price action is essential for Forex traders aiming to prosper in this competitive market.

- Leveraging technical analysis tools provides valuable insights into market sentiment and anticipated price fluctuations.

Mastering the Markets: A Comprehensive Forex Trading Analysis

The forex market, a dynamic and volatile realm of international currency exchange, presents both immense potential and significant hazards. To prosper in this complex environment, traders require a comprehensive understanding of market trends and a disciplined strategy. A comprehensive forex trading analysis encompasses a wide range of elements, including fundamental analysis that examine economic indicators, geopolitical events, and central bank policies, as well as technical patterns that decipher price movements and historical data.

Moreover, traders must hone risk management strategies to protect their capital and minimize potential losses.

- Formulating a sound trading plan that aligns with individual risk tolerance is paramount.

- Leveraging appropriate trading tools can enhance market visibility.

- Regularly educating oneself about market developments is essential for staying ahead of the curve.

Venturing into The Forex Analysis Journey: From Novice to Expert

Your quest in the dynamic world of Forex analysis begins with understanding the fundamentals. Start by learning with market structures. Delve into technical analysis, mastering belajar trading forex indicators like RSI and MACD, and explore macroeconomic factors that influence currency movements. As you progress, hone your skills by analyzing historical charts and practicing with virtual trading accounts. Don't be afraid from seeking guidance from experienced traders or mentors. Regularly refine your strategies, embrace risk management, and remember that consistency is key to achieving Forex analysis proficiency.

- Forge a sound trading plan.

- Validate your strategies rigorously.

- Stay informed about market events.

Decoding of Forex Trading: Analyzing Markets for Profit

Forex trading is a dynamic and complex/intricate/nuanced endeavor that demands a keen understanding of financial markets. Successful traders don't merely/simply/just rely on hunch/luck/instinct; they cultivate/hone/develop their analytical skills to identify profitable opportunities.

Fundamental/Technical/Quantitative analysis forms the bedrock of this process, allowing traders to discern/interpret/uncover trends and patterns that foreshadow/indicate/suggest future price movements. By meticulously/diligently/thoroughly studying economic indicators, geopolitical events, and market sentiment, experienced forex traders can gain/acquire/develop valuable insights into the forces driving/influencing/shaping currency valuations.

However/Nevertheless/Nonetheless, mastering the art of forex trading requires more than just analytical prowess/intellectual capacity/sharp mind. It also demands discipline/dedication/commitment to a well-defined trading strategy, sound risk management/prudent capital allocation/calculated exposure, and the ability to adapt/adjust/modify one's approach in response to ever-changing market conditions.

Molly Ringwald Then & Now!

Molly Ringwald Then & Now! Melissa Joan Hart Then & Now!

Melissa Joan Hart Then & Now! David Faustino Then & Now!

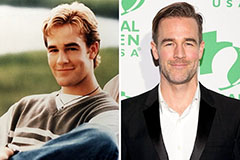

David Faustino Then & Now! James Van Der Beek Then & Now!

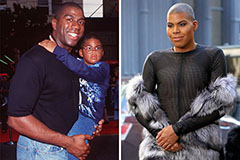

James Van Der Beek Then & Now! Earvin Johnson III Then & Now!

Earvin Johnson III Then & Now!